Authored by Ted Dabrowski and John Klingner via Wirepoints.org,

Chicagoans are buried under so much pension debt it’s impossible to see how their city can avoid a fiscal collapse without major, structural reforms. The futility of paying down those debts becomes obvious when you try to figure out just who’s going to pay for it all.

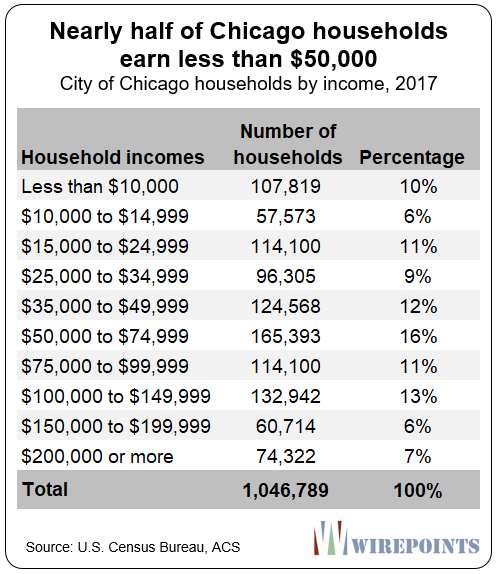

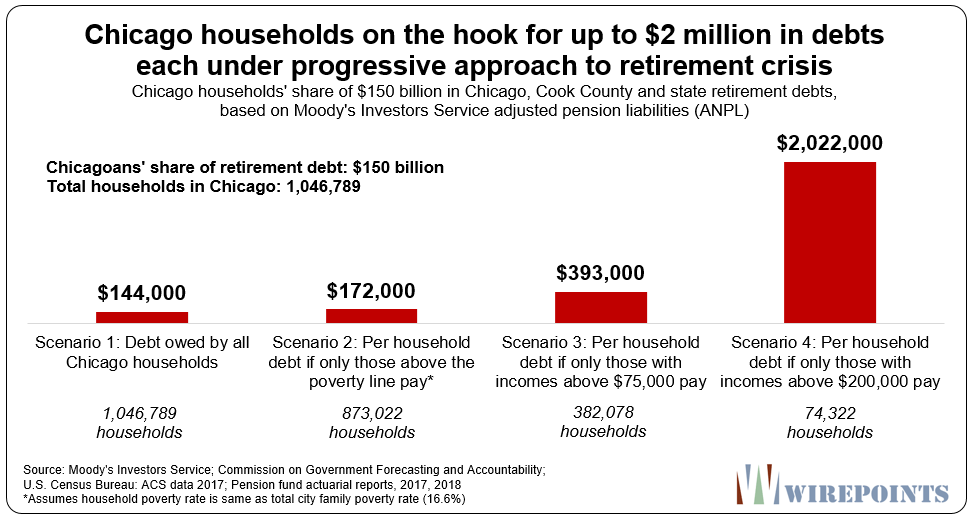

The total amount of city, county and state retirement debt Chicagoans are on the hook for is $150 billion, based on Moody’s most recent pension data. Split that evenly across the city’s one million-plus households and you arrive at nearly $145,000 per household.

That’s an outrageous amount, but it would be a clean solution if each and every Chicago household could simply absorb $145,000 in government retirement debt. The problem is, most can’t.

So if that won’t work, why not just put all the burden on Chicago’s “rich?” After all, Illinois lawmakers are pushing progressive tax schemes as the panacea for Illinois’ problems.

If households earning $200,000 or more are the target, they’ll be on the hook for more than $2 million each in government retirement debts. That’s an outrageous burden, too.

Saddling just a few households with all the debt will give those residents all the more reason to leave. And that will make the burden all the more unbearable for the Chicagoans who remain.

The process to target Chicago’s “rich” already started earlier this year. That’s when state lawmakers passed a progressive tax scheme which, if approved by voters in 2020, will hit Illinoisans earning more than $250,000 with tax increases as large as 60 percent. Chicago’s special interest groups want to hit the rich as well. They’re demanding a dedicated city income tax and a financial transaction tax that will impact the city’s wealthier residents.

Trying to find some middle ground on divvying up Chicagoans’ pension debts is also impossible. If all lower and middle income households earning up to $75,000 are protected, that leaves just 37 percent of Chicago households to pay the $150 billion bill. The burden on them would total $393,000 each. Still crazy.

Slice up Chicago’s debts anyway you like it, but the result is the same. There’s simply too much of it for Chicagoans to bear. Without structural pension reforms, expect the city to continue its path deeper into junk territory and an eventual insolvency. That will inflict enormous pain not just on taxpayers, but on the workers counting on the government for their retirement security.

Adding up the debt

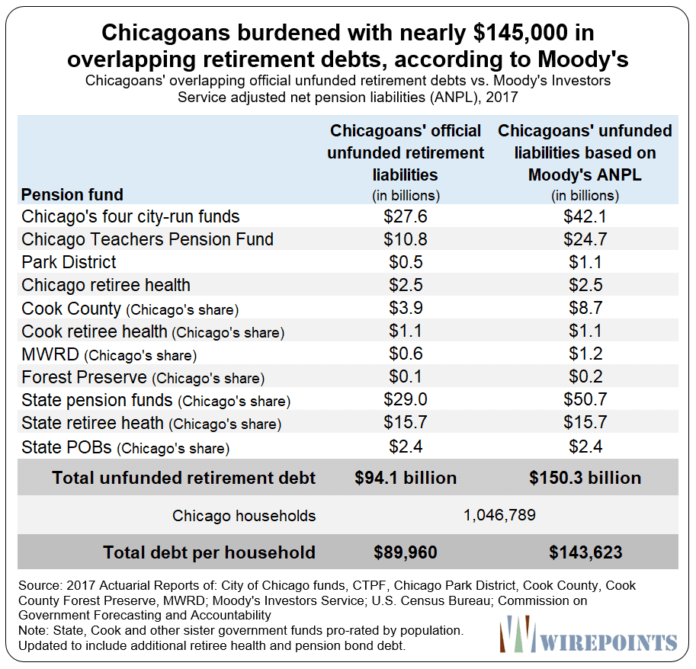

For decades, official government reports have understated the true amount of pension debt Illinoisans are on the hook for. Government calculations have been criticized by the likes of Warren Buffet and Nobel Prize winners for using improper actuarial assumptions. For that reason, Wirepoints’ uses pension debts calculated by Moody’s Investors Service. The rating agency takes a more conservative approach to measuring debts than state officials do.Chicago has four city-run pension funds that collectively face a $42 billion shortfall. The Chicago Public Schools’ pension fund is short another $24 billion. In all, there’s a $70 billion shortfall in the city-based funds alone.

Chicagoans are also burdened with an additional $11 billion in debt – their share of debts owed by various Cook County governments.

And Chicagoans’ share of state retirement debts for pensions, retiree health and pension bonds adds another $69 billion.

In total, Chicago households are on the hook for $150 billion in combined retirement debts.

Chicago the outlier

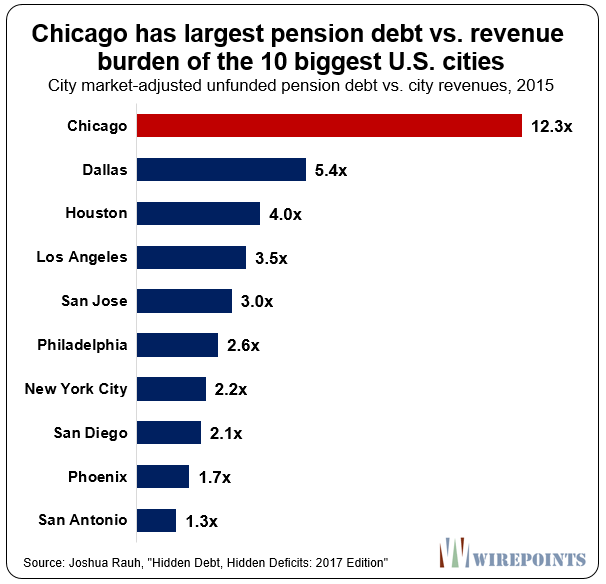

Not only are those debts overly burdensome to Chicagoans, but the city’s debts alone make Chicago a major outlier nationally when it comes to retirement debt.According to Joshua Rauh of the Hoover Institution, the city of Chicago’s pension debts are now 12 times the size of its annual revenues. No other major city faces such a burden.

In fact, according to JP Morgan, over 63 percent of the city’s budget should be going towards retirement payments. That’s the worst of any major city in the nation, by far.

Too much debt is the key reason Chicago’s credit ratings have collapsed. Moody’s already rates Chicago one notch into junk and the Chicago Public Schools five notches into junk. Detroit is the only major U.S. city rated worse than Chicago (See Appendix 2).

Impossible without reforms

The above numbers show the impossibility of stopping Chicago’s fiscal decline without serious, structural pension reforms.Some pension proponents will find offense with our use of Moody’s debt numbers – they’ll say Moody’s assumptions are too pessimistic and overstate the problem.

But the debt burdens are still unworkable even if official government numbers are used. The average Chicago household is still on the hook for $90,000 in debt under the official numbers, while households making $200,000 or more would still face a burden of more than $1.2 million each.

Without structural changes, those numbers will only get worse.

For starters, lower discount rates and more conservative actuarial assumptions continue to show that pension debts are much larger than politicians say they are.

Second, as in-migration into Chicago slows and out-migration increases – a fair assumption given that Chicago has shrunk four years in a row – the debt burden on those who remain will rise.

And third, the risk of a recession is growing now that the nation’s economic expansion has lasted an unprecedented ten years. Any significant pull-back in the stock market would deal a major blowto Chicago’s deeply underfunded pension plans.

Tax hikes won’t solve Chicago’s massive debt problem.

Only structural reforms, including changes to cost-of-living adjustments – will make the city affordable again for the ordinary Chicagoan. And that requires an amendment to the state’s constitutional protections.

From: https://www.zerohedge.com/news/2019-06-30/wealthy-chicago-households-hook-2-million-debt-each-under-progressive-solution

Chicago and New York have kicked the can down the road for so many years there is no return.

ReplyDeleteFiscal responsibility is not a priority.

1 more thought.....Who cares, let the cities die of their own doing.

well said mr hanner

ReplyDeleteyou get what you reap and many cities have reaped the grim reaper